Are You Paying Too Much to Sell Your Home? What Every Homeowner (Especially Seniors) Needs to Know About Commissions

Are You Paying Too Much to Sell Your Home? What Every Homeowner (Especially Seniors) Needs to Know About Commissions

Imagine this: You’ve spent years building equity in your home, planning for retirement, your children’s future, or maybe just a well-deserved adventure. But when it’s finally time to sell, you’re handed a bill for $30,000, $40,000—even $50,000—just in real estate commissions. That’s enough to fund a grandchild’s education, help with medical expenses, or leave a meaningful inheritance. So, why are homeowners still paying so much to sell in today’s market?

The Outdated Commission Model: Why It Matters More Than Ever

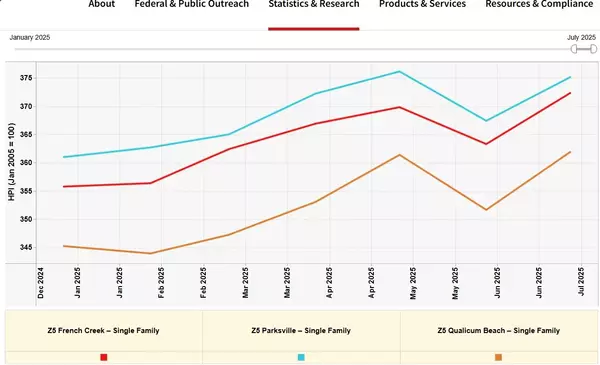

In our area, the traditional commission structure is often, amost always 7% on the first $100,000 and 3% on the balance according to stats. This model was created decades ago, when homes were worth $150,000—not the $850,000 to $900,000 average we see today. Let’s do the math: on a $900,000 sale, that’s $7,000 on the first $100,000, plus $24,000 on the remaining $800,000, for a total of $31,000 in commissions. And that’s just the starting point—some sellers pay even more! It’s a system that hasn’t kept up with skyrocketing home values, and the burden falls squarely on you, the homeowner and its upt o the homeowbers, (YOU) to claim your power back.

Where Does All That Money Go?

It’s a fair question. Many homeowners assume a big commission means a big marketing budget, but that’s not always the case. Before you sign a listing contract, ask your agent:

- “How much did you spend advertising your last three listings?”

- “Can you show me a breakdown of exactly where my commission dollars go?”

- “What services are included, and what will actually help my home sell for top dollar?”

Ask the Tough Questions—You Deserve Answers

- “Are your commissions negotiable?”

- “When was the last time you negotiated from the traditional 7/3% model?”

- “Why should I pay a higher commission just because my home is worth more?”

Don’t be afraid to crunch the numbers and compare your options. Remember, just because something is ‘traditional’ doesn’t mean it’s right for you today.

A Special Word for Seniors: Protecting Your Legacy

Our community has the highest saturation of seniors in all of Canada. That means more of our neighbors are relying on their home’s equity for retirement, health care, and family support. If you’re a senior homeowner, you deserve to keep as much of your hard-earned investment as possible. Don’t let outdated commission models chip away at your legacy.

I’m Not Just Another Agent—I’m Your Advocate

My mission is simple: to help homeowners, especially seniors, keep more of what they’ve worked a lifetime for. If you’re thinking of selling, let’s sit down and review your options together—with full transparency and no pressure. You’ve built your future; let’s protect it.

Have questions or want a free advice? Reach out anytime. Your equity, your legacy, your choice.

I'm Here When Life Moves You...

Categories

Recent Posts

REALTOR® | Seniors Real Estate Specialist®

+1(250) 951-8950 | brenda@oceansidehomesales.ca